The Great Deleveraging: As Retail Gets Wrecked, A New Institutional Market Structure

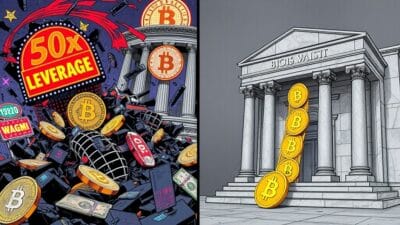

A historic, leverage-driven liquidation event just ripped through the crypto market, but the resulting carnage wasn’t the real story. The key takeaway is the tectonic shift in market structure it exposed. For the first time, the institutional-grade Chicago Mercantile Exchange (CME) has surpassed retail-heavy giants like Binance in futures open interest, signaling a quiet changing of the guard from leveraged speculators to strategic capital.

While the weekend’s crash was fueled by fears of a US-China trade war, its primary effect was a massive deleveraging, wiping out a record $74 billion in leveraged positions. This wasn’t a crisis of fundamentals; it was a cleansing of speculative excess. The real alpha lies in what happened next: a clear bifurcation between the retail casino and the institutional treasury.

A Tale of Two Markets: The Institutional Takeover

The Flippening in Open Interest

In the wake of the crash, the market’s center of gravity shifted decisively. Aggregate futures open interest in top cryptocurrencies at the CME reached $28.3 billion, eclipsing Binance’s $23 billion. This is more than a statistic; it’s a structural realignment.

The CME, with its cash-settled contracts and ~2.5x leverage limits, is the natural home for institutions. In contrast, unregulated exchanges offering up to 100x leverage cater to a different crowd. The fact that the institutional venue held firm while others saw a 22% drop in open interest reveals who panicked and who held the line.

Buy the Dip, But Make it Corporate

While leveraged retail traders were getting liquidated, corporate treasuries and institutional players were calmly accumulating. According to Bitwise, a staggering 95% of all ETH held by public companies was purchased in the third quarter alone, a period of significant price consolidation. This represents over 4 million ETH added to corporate balance sheets.

This trend was on full display this week. As Ether’s price retreated, BitMine Immersion Technologies, chaired by Tom Lee, reportedly scooped up another 104,336 ETH worth around $417 million. This follows their acquisition of 202,037 ETH just days earlier. This isn’t speculative froth; it’s a calculated, long-term treasury strategy unfolding in real-time.

Beneath the Volatility: Upgrades and Guardrails

Ethereum’s Path to 10,000 TPS

The institutional thesis isn’t just built on accumulation; it’s underpinned by foundational technological advancements. While the market was focused on liquidations, Ethereum scaling firm Brevis announced Pico Prism, a zkEVM technology capable of proving Ethereum blocks in near real-time using consumer-grade GPUs.

This breakthrough is a critical step on the Ethereum roadmap toward 10,000 transactions per second (TPS) and a future where nodes can run on a phone. For institutions, this scaling vision—projected by some to be achievable by 2029—transforms Ethereum from a congested settlement layer into a global, high-throughput financial rail, justifying long-term valuation models like VanEck’s $154,000 bull case for ETH.

Transparency Under Fire: The Paxos Paradox

Even operational blunders are becoming proof-of-concept for blockchain’s value proposition. When Paxos accidentally minted $300 trillion in its PayPal stablecoin, the error was identified and burned within 22 minutes precisely because of the blockchain’s public, transparent nature.

Executives like OKX Australia CEO Kate Cooper, a former banker, framed this as a strength, contrasting it with multi-billion dollar “fat-finger” errors at institutions like Citigroup and Deutsche Bank that took hours or even months to be publicly disclosed. This radical transparency, while sometimes messy, is a core feature—not a bug—for a financial system aiming to win institutional trust.

The Regulatory Perimeter Hardens

Simultaneously, the regulatory landscape is maturing. Australia’s move to grant AUSTRAC powers to restrict or ban high-risk crypto ATMs and the Bank of England’s clarification on temporary stablecoin holding limits are not signs of hostility. Rather, they represent the necessary construction of regulatory guardrails that large, compliant institutions require before deploying capital at scale.

Why It Matters

The recent market crash was not a simple price correction; it was a structural reset. The speculative leverage that defined previous cycles is being flushed out, and in its place, a more resilient, institutionally-driven market is taking shape. The data is clear: while short-term traders are being wiped out, corporate treasuries are accumulating, the underlying technology is scaling at an accelerated pace, and the regulatory framework is solidifying.

This great deleveraging is painful for many, but it’s ultimately forging a market structure that is less susceptible to cascading liquidations and more aligned with long-term, strategic capital. The era of the retail-driven casino may be ending, making way for a market defined by corporate balance sheets, technological milestones, and regulatory clarity. This is probably nothing.