Beyond Market Noise, Today’s Key Signals

Cryptois reads between the lines of complex market data, interpreting the links between on-chain metrics and macroeconomics to deliver the most critical investment signals each day.

Crypto’s Great Divide: While Retail Cools, Institutions Build the New Financial

A new FINRA study shows waning retail crypto interest, yet institutional players are doubling down on infrastructure. This brief analyzes the market’s bifurcation, driven by regulatory clarity and a new wave of building.

Wall Street’s Crypto Gambit: A Two-Front War of Integration and

Wall Street is waging a two-front war on crypto, strategically integrating Bitcoin via giants like BlackRock while lobbying to contain DeFi’s disruptive potential through regulatory pressure from players like Citadel Securities.

The Great Convergence: Wall Street Builds The Bridge As Crypto-Native Currents

The crypto market is in a two-speed evolution as Wall Street giants like BlackRock and Bank of America build the bridge to TradFi through tokenization and ETFs, while on-chain data reveals divergent strengths in assets like Solana and Bitcoin.

The Great Rotation: As Vanguard and Goldman Wade In, Crypto’s Public Champions Face a

As Wall Street giants like Vanguard and Goldman Sachs embrace crypto ETFs, a brutal market correction is testing crypto-native digital asset treasuries. This analysis explores the pivotal shift in market structure, where TradFi’s entry coincides with a great deleveraging event for pioneers like Strategy Inc.

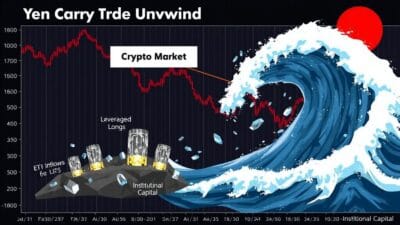

The Great Unwind: How a Bank of Japan Policy Shift Is Testing Crypto’s New Financial

Bitcoin’s sharp drop to $85.5k, driven by a potential Bank of Japan rate hike, triggers a $656M liquidation cascade. This macro shock tests a maturing crypto market, where resilient ETF inflows and a more transparent lending structure signal growing institutional strength.

Bitcoin ETF Flows & Nasdaq’s Tokenization Push Reveal a Market’s Structural

An analysis of the crypto market’s structural shift, where institutional ETF flows from giants like BlackRock and Nasdaq’s tokenization plans collide with crypto-native risks like insider trading, infrastructure fragility, and divided on-chain sentiment.