The $20B Cleanse: How a Tariff Tweet Exposed Crypto’s Deep Leverage Crisis and a Tale of Two

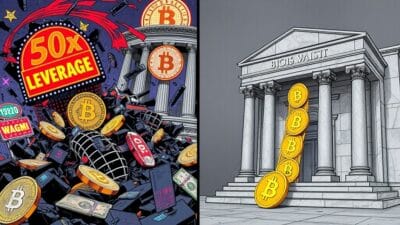

Friday’s historic market crash, which vaporized over $20 billion in leveraged positions, was far more than a knee-jerk reaction to a Donald Trump tweet. It was the violent, inevitable detonation of a leverage-fueled powder keg, exposing critical fractures in market infrastructure and revealing a starkly divided landscape: the disciplined, long-term institutional players versus the hyper-leveraged “degen casino.” While retail traders pointed fingers at geopolitics, the real story lies in the system’s own excesses and the divergent behavior of its participants.

This event wasn’t just a price correction; it was a systemic stress test that the market’s plumbing spectacularly failed. The fallout has prompted calls for regulatory probes and laid bare the immense risks lurking within decentralized and centralized trading venues alike, forcing a painful but necessary market “cleanse.”

A Powder Keg Meets a Geopolitical Spark

The Catalyst vs. The Cause

While President Donald Trump’s announcement of a 100% tariff on Chinese goods was the undisputed catalyst, market analysts were quick to label it a convenient scapegoat. According to on-chain analytics firm Santiment, this is “typical ‘rationalization’ behavior from retailers” seeking a singular cause for a cataclysmic event. The real culprit, as analysts from The Kobeissi Letter noted, was the “excessive leverage and risk” that had saturated the market.

The numbers paint a damning picture of a market heavily biased to the upside and ripe for a squeeze. A staggering $16.7 billion in long positions were liquidated compared to just $2.5 billion in shorts—a nearly 7-to-1 ratio. This imbalance created a fragile structure where any significant shock, amplified by thin weekend liquidity, was guaranteed to trigger a cascade of forced selling.

The Plumbing Breaks: Exchanges Under Fire

As the liquidation cascade began, the market’s infrastructure buckled under the strain. The event triggered the most severe liquidation in crypto history, with data from CoinGlass showing nearly $20 billion in wiped-out positions. The decentralized perpetuals exchange Hyperliquid was the epicenter, recording an astonishing $10.31 billion in liquidations, followed by Bybit ($4.65 billion) and Binance ($2.41 billion).

The fallout was immediate. Crypto.com CEO Kris Marszalek called for regulators to “conduct a thorough review of fairness of practices,” questioning whether exchanges slowed down, mispriced assets, or failed to maintain proper controls. His concerns were validated when Binance confirmed a price depeg incident involving tokens like Ethena’s USDe led to forced liquidations, prompting an apology from co-founder Yi He and a promise of compensation for platform-related errors. This highlights a critical risk: even for traders with sound strategies, infrastructure failure remains a potent and unpredictable threat.

A Tale of Two Markets: Sharks Buy While Institutions Hedge

The Disciplined Hand of Smart Money

Beneath the surface of the liquidation chaos, a completely different story was unfolding. On-chain data from Glassnode revealed that while leveraged traders were being wiped out, “sharks”—wallets holding between 100 and 1,000 BTC—were aggressively buying the dip. The Shark Net Position Change surged to its highest level since 2012, indicating that experienced, large-scale holders viewed the panic as a buying opportunity, not a reason to flee.

This disciplined behavior extends to the institutional realm. Glassnode’s analysis of the options market showed that leading up to the crash, institutional traders were not chasing the rally with euphoric call buying. Instead, they were cautiously hedging, with strong demand for put options and a put-call ratio climbing above 1.0, signaling a clear focus on capital preservation.

The Unfazed March of Adoption

The macro trend of institutional adoption appears entirely disconnected from the short-term market carnage. Analysts at Deutsche Bank are now drawing direct parallels between gold and Bitcoin, predicting that central banks could begin accumulating BTC as a reserve asset by 2030. This sentiment is already in motion, as Luxembourg’s sovereign wealth fund recently announced it had allocated a portion of its portfolio to Bitcoin ETFs. This bifurcation is crucial: one market is playing high-stakes poker with leverage, while the other is quietly building a strategic, long-term position in the asset class.

Why It Matters

This $20 billion “cleanse” serves as a brutal reminder that the crypto market remains a dual-natured entity. On one side, the speculative, high-leverage casino is prone to violent implosions that can be triggered by the slightest tremor. On the other, a maturing, institutionally-driven market is demonstrating resilience, strategic foresight, and a focus on long-term value.

The key takeaway is that the washout of excessive leverage, while painful, is ultimately healthy. It removes unsustainable froth and forces a reckoning with the fragile state of market infrastructure. For the bull market to have durable legs, it must be built on the steady foundation of spot accumulation and institutional discipline, not the shaky stilts of 50x leverage. The question now is whether the industry can learn from its infrastructural failures and build a more robust system before the next wave of capital arrives.