The Great Unwind: How a Bank of Japan Policy Shift Is Testing Crypto’s New Financial

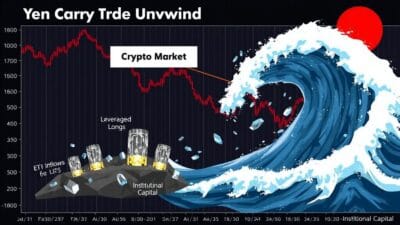

A brewing storm in Tokyo is sending shockwaves through crypto, triggering a brutal deleveraging event that wiped out over half a billion in leveraged positions. Bitcoin’s sharp pullback to the mid-$85,000s isn’t just random volatility; it’s a direct consequence of soaring expectations for a Bank of Japan (BoJ) rate hike, forcing a painful unwind of the massive “Yen Carry Trade” and stress-testing the crypto market’s newly fortified institutional infrastructure.

This isn’t just another market dip. It’s a clear signal that crypto is now inextricably linked to global macro liquidity, where a policy shift from one of the world’s last zero-interest-rate holdouts can spark a contagion event across high-risk assets.

The Yen Carry Trade’s Crypto Contagion

A Tsunami of Liquidations from Tokyo

The market’s sudden lurch downwards saw Bitcoin plummet 5.5% to as low as $85,616, liquidating a staggering $656 million in leveraged long positions across the board. The catalyst, according to analysts like BitMEX co-founder Arthur Hayes, is the increasing likelihood of the Bank of Japan hiking interest rates for the first time since 2008 at its upcoming December 18-19 meeting.

For decades, investors have borrowed Yen at near-zero interest to invest in higher-yielding, riskier assets globally—the “Yen Carry Trade.” With Japanese 2-year yields hitting their highest since 2008 and bond investors pricing in a 76% chance of a rate hike, that trade is becoming costly to maintain. As Coinbureau’s Nic noted, a strengthening Yen forces a mass unwinding of these positions, compelling the sale of risk assets like crypto. This isn’t theoretical; a surprise BoJ hike in August 2024 previously triggered a 20% BTC crash and $1.7 billion in liquidations.

A Tale of Two Flows: Fragile Leverage vs. Resilient Institutions

Deleveraging Dominoes and Bearish Technicals

The immediate fallout is a market structure riddled with fear. The massive liquidation cascade, with Bitcoin longs accounting for $188.5 million of the total, underscores the vulnerability of over-leveraged retail and derivatives traders. From a technical standpoint, the picture looks grim, with BTC validating a bear flag pattern that projects a potential drop toward $67,700.

Adding to the anxiety, network economist Timothy Peterson’s analysis reveals that Bitcoin’s price action in the second half of 2025 has a near 98% monthly correlation to the 2022 bear market bottom. This suggests the pain might not be over, with a true rebound potentially delayed until Q1 of next year.

The Institutional Bid Holds Firm

But while speculative leverage gets flushed out, a different, more resilient story is unfolding in the institutional camp. For the first time since late October, spot Bitcoin and Ethereum ETFs have broken their outflow streak. Bitcoin ETFs saw net inflows of $70 million, while Ethereum ETFs pulled in a more substantial $312.62 million in the final week of November.

This divergence is critical. While hot money flees, stickier institutional capital from players like Fidelity and BlackRock appears to be absorbing the volatility, viewing the dip as a potential entry point. The impending launch of the first spot Chainlink (LINK) ETF by Grayscale further signals that the institutionalization of crypto assets continues unabated, building a more robust long-term foundation for the market.

Building in the Bear: Regulatory Clarity and Market Maturity

East vs. West Regulatory Divergence

The global regulatory landscape continues to mature, albeit with sharp regional differences. The People’s Bank of China (PBOC), in a meeting with 12 other agencies, reaffirmed its stringent 2021 crypto ban, flagging stablecoins as a particular risk for money laundering and vowing to crack down on a “resurgence in speculation.”

In stark contrast, Ripple just received expanded approval from the Monetary Authority of Singapore (MAS) for its Major Payment Institution license. This move solidifies Singapore’s status as a key crypto hub and highlights the growing importance of regulatory clarity for companies building cross-border payment infrastructure in the booming Asia-Pacific region, which saw on-chain activity jump roughly 70% year-over-year.

A More Transparent Lending Market

The crypto lending market itself is a testament to a healthier ecosystem. After the catastrophic collapses of firms like Celsius, BlockFi, and Genesis in 2022, the sector has rebounded to a combined outstanding loan book of $65.4 billion. Crucially, this recovery is led by more transparent players. Stablecoin issuer Tether now dominates with a $14.6 billion loan book and quarterly attestations, while public companies like Galaxy provide clear financial reporting. Uncollateralized lending has largely vanished, replaced by stricter risk controls—a sign of a market that has learned painful lessons.

Why It Matters

The key takeaway is that crypto has graduated into the major leagues of global finance, for better and for worse. Its sensitivity to systemic liquidity shifts, like the potential unwind of the Yen Carry Trade, demonstrates its integration into the broader macro landscape. The days of crypto operating in an isolated bubble are definitively over.

However, this macro fragility is being met with increasing structural strength. The resilience of ETF inflows, the progress in regulatory clarity in key jurisdictions like Singapore, and the emergence of a more transparent and collateralized lending market all point to a more durable ecosystem. The current turmoil is a stress test, washing out unsustainable leverage while rewarding the long-term conviction of institutional players who are building on crypto’s new, more solid foundations.