The Great Bifurcation: Crypto’s Two-Track Future of Regulated Rails and On-Chain

The crypto market is undergoing a fundamental split, creating two parallel universes that barely resemble one another. On one track, a regulated, institutional-grade financial system is being meticulously constructed on stablecoin rails. On the other, the native on-chain economy continues its own Darwinian evolution, driven by whale rotations, shifting protocol economics, and a relentless search for alpha. This isn’t a single market anymore; it’s a bifurcation of purpose and structure.

The Stablecoin Compliance Engine Roars to Life

Europe Sets the Pace with MiCA

The “suit” track is rapidly gaining momentum, with regulators globally laying down the law for stablecoins. In Europe, Aave Labs just became one of the first major DeFi projects to secure authorization under the new Markets in Crypto-Assets (MiCA) regulation, greenlit by the Central Bank of Ireland. This allows its “Push” service to offer regulated, zero-fee euro-to-GHO stablecoin conversions, creating a compliant bridge directly into the Aave ecosystem.

This move, which follows Kraken also securing its MiCA license in Ireland, signals that the era of regulatory ambiguity for stablecoins in Europe is officially over. It establishes a clear, predictable pathway for protocols to connect with the traditional banking system, turning what was once a gray area into a well-lit superhighway for institutional capital.

The US Builds its Own On-Ramps

Across the Atlantic, a similar story is unfolding, albeit with a distinct American flavor. FDIC Acting Chair Travis Hill confirmed the agency is developing guidance for tokenized deposit insurance and plans to launch an application process for stablecoin issuers by the end of 2025. This is all part of implementing the landmark GENIUS Act, which establishes the first federal framework for payment stablecoins in the US.

The message from regulators is clear: a deposit is a deposit, whether it’s on a legacy ledger or a blockchain. This regulatory clarity is already sparking a wave of institutional infrastructure development.

Case in point: banking giant BNY Mellon just launched a money market fund specifically designed to hold cash reserves for US stablecoin issuers. This isn’t a speculative play; it’s the boring, essential plumbing required to make the system work at scale, providing the trust and transparency institutions demand. Meanwhile, players like MoonPay are pivoting their entire business models to become full-stack stablecoin infrastructure providers, betting that this regulated ecosystem is the future.

On-Chain Darwinism: Whales Rotate and Miners Pivot

Whale Watching: It’s a Cycle, Not a Crisis

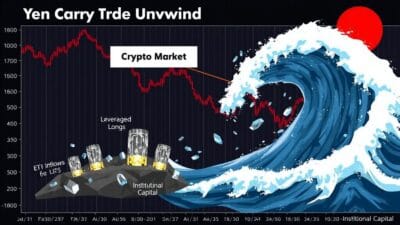

While the compliance engine gets built, the on-chain world continues to operate by its own rules. Recent selling pressure from Bitcoin whales, including a notable 2,400 BTC transfer to Kraken by trader Owen Gunden, has spooked parts of the market. However, analysts at Glassnode suggest this is “normal bull-market behavior,” not a sudden exodus.

According to their data, monthly average spending by long-term holders has climbed to around 26,000 BTC per day. This reflects a steady, structured profit-taking cycle typical of late-stage bull runs, where older cohorts distribute into rising demand. As Kronos Research CIO Vincent Liu puts it, this is “steady profit rotation, rather than panic,” suggesting the market top isn’t necessarily in.

The Great Miner Migration

A more profound structural shift is happening in the mining sector. Bitfarms sent shockwaves through the industry by announcing it will shutter its Bitcoin mining operations over the next two years to pivot entirely to AI and high-performance computing (HPC). CEO Ben Gagnon stated bluntly that converting just their Washington site could “produce more net operating income than we have ever generated with Bitcoin mining.”

Gagnon’s thesis is that the economics are driving this transition. Bitcoin mining is location-agnostic and will chase the lowest-cost energy globally, moving to the Middle East, Africa, and Russia. For miners in the US, however, the “best opportunity… really is this transition to HPC and AI.” This is a stark reminder that the physical infrastructure layer of crypto is not immune to broader technological and economic trends.

Why It Matters

The crypto market is maturing into two distinct but interconnected ecosystems. The “regulated” layer, built on compliant stablecoins and institutional-grade infrastructure, is providing the legitimacy and on-ramps necessary for mainstream adoption and massive capital inflows. It’s becoming predictable, audited, and integrated.

Simultaneously, the “on-chain” layer remains the wild heart of crypto—a dynamic, often chaotic arena where market cycles play out, whales dictate short-term flows, and core business models like mining are forced to evolve or die. The key takeaway is that the era of a monolithic “crypto market” is ending. Investors, developers, and users must now consciously decide which track they are on, as the rules, risks, and rewards of each are rapidly diverging. Probably nothing.