Crypto’s Civil War: Regulation Builds Fences as Debates Rage Over the Network’s

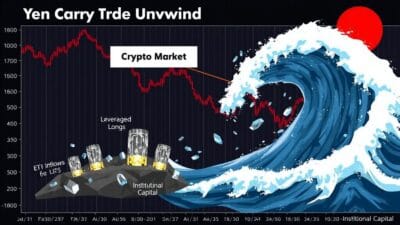

The crypto market is being pulled in two directions at once, caught in a foundational tug-of-war. On one side, a powerful wave of institutionalization and regulation is building fences around the digital frontier, seeking to tame and integrate it. On the other, fierce internal debates and the relentless rise of decentralized finance reveal a native, permissionless spirit that refuses to be domesticated.

This conflict isn’t just background noise; it is rapidly becoming the single most important narrative shaping the future of digital assets. The resolution will determine whether crypto becomes just another line item on a balance sheet or fulfills its promise of a fundamentally different financial architecture.

The Great Enclosure: Regulation Builds Its Walls

The wild, unregulated days of crypto are decisively over. A coordinated, global effort is underway to make the ecosystem legible and accountable to existing power structures, effectively building a regulatory perimeter around the on-chain world.

The Taxman Cometh, On-Chain

The myth of crypto anonymity is being systematically dismantled. Global bodies like the OECD are implementing frameworks like the Crypto-Asset Reporting Framework (CARF) to enable automatic data sharing between tax authorities across borders. This isn’t a future plan; it’s happening now.

Tax agencies such as the IRS in the US and HMRC in the UK are no longer guessing. They are actively contracting with blockchain analytics firms like Chainalysis to trace transactions across complex DeFi protocols and even privacy coins, linking pseudonymous wallets to real-world identities. The message is clear: every swap, sale, and yield farm reward is a data point, and the tools to track them are now state-of-the-art.

Canberra’s Cautious Blueprint

Governments are moving from enforcement to framework creation. Australia’s draft crypto legislation is a prime example, extending existing financial services laws to cover digital asset platforms. While the industry, including figures like Caroline Bowler of BTC Markets, supports the intent, there’s a strong pushback for greater clarity.

Crypto exchange Swyftx noted the draft gives regulators “a high degree of discretion” and lacks specifics on crucial issues like sourcing liquidity from offshore exchanges. This push-and-pull highlights the delicate dance between regulators seeking control and innovators needing well-defined, workable rules.

The Centralization Paradox

Perhaps the most ironic fence is the one crypto has built around itself. The recent Amazon Web Services (AWS) outage was a stark reminder of Web3’s deep dependency on Web2 infrastructure. Platforms like Coinbase, MetaMask, and Robinhood went down not because their underlying blockchains failed, but because their user-facing interfaces are hosted on centralized servers.

As Jawad Ashraf, CEO of Vanar Blockchain, pointed out, with an estimated 70% of Ethereum nodes hosted on AWS, Google, or Microsoft, the industry is “just paying three different landlords instead of one.” This operational reality creates a massive single point of failure, a centralized chokepoint that runs counter to the entire ethos of decentralization.

The Code Wars: Debating Crypto’s Core Principles

While the suits build their walls from the outside, an equally intense battle is raging within. Developers and users are engaged in existential debates over the fundamental principles of these networks, proving the ecosystem’s soul is very much up for grabs.

Bitcoin’s Existential Crisis

A new soft fork proposal from developer Luke Dashjr, aimed at restricting non-financial data on the blockchain, has ignited a firestorm. Critics have blasted the proposal’s language, which states “there is a moral and legal impediment to any attempt to reject this soft fork,” as a thinly veiled threat.

Prominent figures like cryptographer Peter Todd labeled it an “attack on Bitcoin” driven by “legal threats,” while others warned it could create perverse incentives for malicious actors. This isn’t just a technical squabble; it’s a philosophical war over Bitcoin’s purpose: is it a purely monetary network, or a permissionless canvas for any and all data? The outcome will set a powerful precedent.

DeFi’s Quiet Coup

While Bitcoin debates its identity, the decentralized finance sector is quietly proving its superiority. As detailed by Rachel Lin, co-founder of SynFutures, DeFi is steadily capturing market share from its centralized counterparts. In Q2, top DEXs saw spot volumes grow 25% while CEX volumes declined 28%.

This shift is driven by user preference for transparency and self-custody, especially after the catastrophic collapses of centralized lenders like Celsius and BlockFi. DeFi protocols are innovating faster, offering everything from on-chain order books to complex derivatives, all governed by code rather than corporate promises. The market is voting with its capital, and it’s choosing decentralization.

Why It Matters

The crypto market’s next cycle will be defined by this core tension. The “Great Enclosure” by regulators and reliance on centralized infrastructure brings legitimacy and opens the door for massive institutional capital, but it also risks neutering the very properties that make crypto unique.

Simultaneously, the “Code Wars” and the rise of DeFi protect the ecosystem’s permissionless ethos but can appear chaotic and risky to the outside world. The most resilient and valuable projects will be those that can successfully navigate both fronts—satisfying regulatory requirements without sacrificing their decentralized soul. For investors, watching the fence-builders and the code-debaters is now equally important.