The Great Treasury Bifurcation: Beyond the Saylor Playbook, a New Market

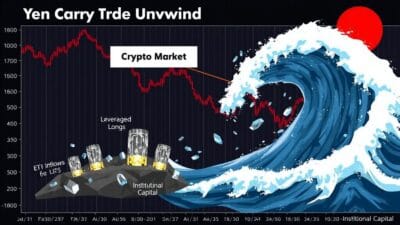

The corporate crypto treasury narrative, once a straightforward story of Bitcoin accumulation, is hitting an inflection point. The market is bifurcating into two distinct camps: the crowded field of pure-play asset holders now facing diminishing returns, and a new wave of sophisticated players building the next layer of financial infrastructure. The game is evolving from simple accumulation to complex application.

This shift signals a maturation of the market, where just holding the asset is no longer the only—or even the most interesting—play. The next cycle’s winners will be defined not by the size of their stack, but by their ability to make those assets productive.

The Playbook Goes Mainstream… And Hits a Wall

The BTC Treasury Boom

The playbook written by Michael Saylor‘s Strategy (formerly MicroStrategy) has become the institutional standard. Publicly traded companies like Next Technology Holding and others have followed suit, converting cash reserves into Bitcoin as a hedge against inflation and currency risk. This trend has created a structural demand shock, with firms like Fidelity forecasting that corporate buying could render 8.3 million BTC “illiquid” by 2032.

This strategy has been validated by a constant stream of nine-figure purchases, with Strategy itself now holding a staggering 638,985 BTC. The thesis is simple and powerful: acquire a scarce, digital asset to preserve capital over the long term. This has become the baseline for corporate crypto adoption.

Diversification and Saturation

Naturally, the playbook is expanding. As Bitcoin became a more established treasury asset, firms began looking for the next frontier. BitMine Immersion Technologies has made a significant bet on Ether, accumulating over 2.15 million ETH. More recently, the focus has pivoted aggressively toward Solana.

Companies like Forward Industries and Helius Medical Technologies are launching massive, nine-figure Solana treasury initiatives, backed by major players like Pantera Capital, Galaxy Digital, and Jump Crypto. Forward’s initial purchase of over 6.8 million SOL establishes it as the largest Solana treasury on the block, signaling that institutional appetite is moving further out on the risk curve.

The mNAV Compression Problem

But as the trade gets crowded, the alpha is getting harder to find. Look no further than the “mNAV compression” flagged by institutions like Standard Chartered and Coinbase. The mNAV (market-to-net-asset-value) ratio, which measures a company’s market value against its crypto holdings, is collapsing for many of these treasury firms. An mNAV above 1.0 is the magic number that allows firms to issue equity to buy more crypto profitably; below that, the growth engine stalls.

This isn’t just a theoretical risk. Shares in KindlyMD Inc. recently halved after its CEO warned of volatility, and its market cap fell below the value of its Bitcoin holdings. The market is signaling that simply rebranding as a crypto treasury is no longer enough. Differentiation, scale, and a sustainable model are now required to survive the inevitable consolidation.

Phase Two: From Static Reserves to Productive Assets

TradFi Builds the Rails

While pure-play treasuries face a reckoning, a more profound shift is happening elsewhere. Traditional finance isn’t just buying crypto; it’s building the infrastructure for a new market. The London Stock Exchange Group (LSEG) launching its blockchain-based Digital Markets Infrastructure (DMI) is a landmark event. This isn’t a speculative bet on token prices; it’s the creation of regulated, institutional-grade rails for tokenizing private funds.

This move, developed with Microsoft, aims to bring efficiency, transparency, and liquidity to historically slow markets. It represents the “application” layer being built on top of the “asset” layer. Similarly, American Express launching NFT-based travel stamps on Base shows how major brands are using blockchain for user engagement, moving beyond pure financial speculation.

The “Stablecoin 2.0” Thesis

The evolution from static to productive assets is perhaps best captured by the “Stablecoin 2.0” concept, articulated by Tether co-founder Reeve Collins. The first generation of stablecoins digitized the dollar but kept the yield for the issuer. The next generation aims to unbundle the principal from the yield, turning a simple payment token into a dynamic financial instrument.

This model tokenizes both the stablecoin and the income stream from its underlying collateral (like Treasury bills). This allows holders to use the stablecoin for payments while separately holding, trading, or reinvesting the yield-bearing token. While technically complex—requiring solutions for challenges like rebasing tokens and secure governance—it transforms idle cash into a productive, community-owned asset.

The Ecosystem Utility Play

Finally, value is being created at the base layer itself. The Ethereum Foundation‘s new AI-focused research team aims to make Ethereum the neutral settlement layer for an entire economy of intelligent agents. This isn’t about treasury; it’s about fundamentally increasing the utility and demand for the network.

Likewise, Coinbase‘s Base network is exploring a native token and building an open-source bridge to Solana. This focus on interoperability and decentralization aims to grow the entire on-chain economy, making the underlying platforms more valuable and indispensable. It’s a shift from merely holding assets to actively building the ecosystems that give them long-term value.

Why It Matters

The corporate crypto landscape is undergoing a critical bifurcation. On one side, the straightforward strategy of accumulating crypto reserves is becoming a saturated, high-risk game of scale where consolidation seems inevitable. The days of easy premiums for simply adding “Bitcoin” to a company’s name are over.

On the other side, a far more significant trend is emerging. Sophisticated financial players and protocol developers are focused on building the infrastructure and applications that will define the next decade. From the LSEG tokenizing private markets to the architectural shift toward yield-bearing stablecoins, the focus is now squarely on utility and productivity. The market is sending a clear signal: the ultimate winners won’t be the ones who just bought the assets, but the ones who built something valuable with them.